Upgrading finance

WHAT WE THINK

Algorithmic Revolution

We believe that a new industrial revolution has begun.

Previous revolutions originated through chemical and physical innovations. Current revolution is more abstract. And yet much more profound.

This is the algorithmic revolution.

Ever increasing computing power combines with ever deeper algorithms to solve any issues, one after the other. Intelligent technologies are percolating in every sector, in every device, and are definitely changing the world we live in.

When Silicon Valley addresses the issue of cars, it gives Uber or the Google car.

When Silicon Valley meets biology, it invents a customized medicine, where DNA sequencing is fast and affordable for everyone.

What if Silicon Valley met finance?

Silicon Valley Meets Finance

We believe that financial markets do not work as well as modern technologies would allow it. Considering what currently happens anywhere else, the paradigm shift is still to come. Liquidity has dried up in many OTC markets. Markets are fragmented without correction mechanisms between compartments. More serious still, we believe that excessive volatility is inherent to the way current marketplaces operate, with hardly uncontrolled public bid/offer rules.

Till now, the use of technology in finance consisted in doing so called algorithmic trading for individual profit. This is known to cause disequilibrium.

Our matter at Smartpills is a use of technology to build a new kind of finance, with intelligent marketplaces.

Because we think that today’s stake consists in designing powerful algorithms inside marketplaces to improve the way they operate, as Uber or Amazon did it in their own sector.

This allows us to build an upgraded market with better global equilibrium, dynamic recommendations, lower volatility and enhanced liquidity.

WHO WE ARE

Emmanuel FERET

CO FOUNDER & CEOTECHNOLOGY & ALGORITHMS

Emmanuel Feret is working in quantitative finance for 18 years. He knows instruments, market models and price formation mechanisms. He also knows how to solve old problems in finance with modern solutions from different fields.

OTCEX Group

PARTNER & MARKET ACCESSOTCEX Group acts as interdealer broker in interest rates, stocks and commodities in Paris, London, NY, Hong Kong and Geneva.

OTCEX Group offers a privileged access to many OTC and organized markets and is partner of Smartpills.

Jonathan Thabaut

CO FOUNDERMARKETS & TRADING PRACTICES

Jonathan Thabaut is trading options for 10 years. He knows how markets operate and complex trading behaviors.

SMARTPILLS

Everybody thought for years that OTC markets were so complicated that only humans could handle their specific rules. But within a few years, with the support of regulators and because of post-crisis new standards, some electronic platforms emerged and gathered a significant part of liquidity.

These platforms were developed by leading interdealer brokers. They were simple and did the job.

Considering what we knew about market practices and modern algorithms, we quickly understood we could do something different.

Something that could bridge the gap between electronic efficiency and human versatility.

Smartpills was born.

Découvrez le concept Smartpills

WHAT WE DO

We design intelligent marketplaces

OTC markets (bonds, swaps, options…) have specific features. Instruments have several degrees of freedom and they usually trade in complex strategies, where two or more products must trade altogether. Moreover, liquidity is often scarce regarding the huge number of potential instruments.

That makes traditional order book platforms inoperative.

The core of our platforms is a patented algorithm that substantially changes the way it operates.

This algorithm sees the big picture: the market is modeled with any meaningful information in a logical, coherent system and managed in real time with global rules.

For any market configuration and any complex strategy, our algorithm continuously finds and refines matching solutions, satisfying any logical rule.

To go even further, our algorithm gives recommendations to users, to help them update orders that COULD match regarding any valuable market information and collective behavior.

We understand markets

We know market models. When modeled, market prices cannot be retrieved by some book’s formula but with a collection of evolving methods, heuristics and parameters that only market people know: one has to trade to continuously infer and calibrate the right model.

We know market practices. Again, one has to be in the market to understand what a “good price” is or what instrument or strategy looks like another. And to understand individual and collective behaviors in normal or crisis situations.

Finance is only practices even when talking about models. You have to know participants behavior and the question is not to change it.

But you can change the way information is managed among them.

We use cloud computing

Our task is not to handle hardware but information. That’s why our environment is completely dematerialized.

From the very beginning, this allows us to build our solutions with high availability and scalability. Without infrastructure, we have perfect reactivity.

Our set of processes is organized in a logical graph and is managed automatically, with intelligent rules. That means that a sub-group of processes can be restarted in the causal sequence or rescaled when needed, without human intervention.

This unique cloud computing expertise allows us to focus on essential things.

OUR WORK

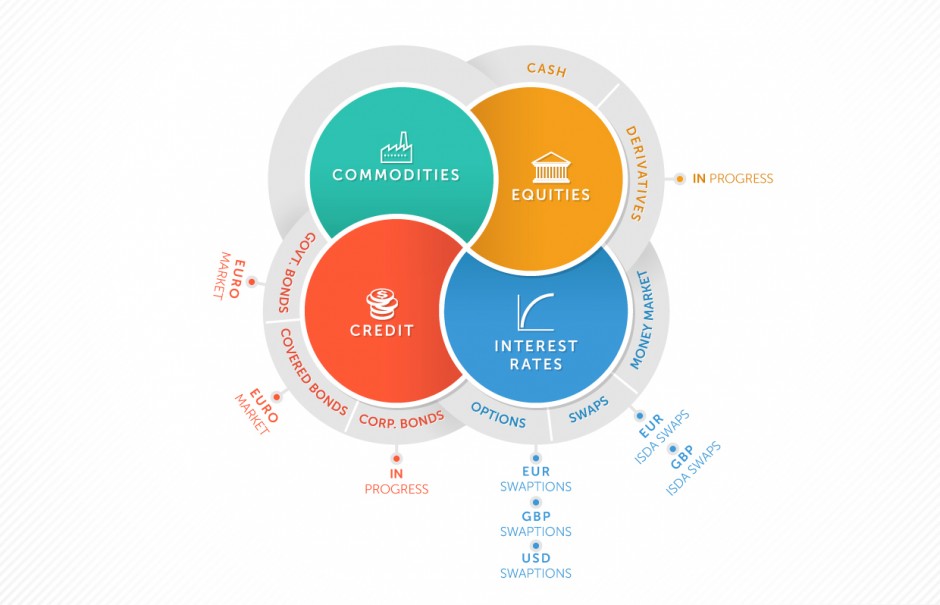

We are building a platform ecosystem to cover a large range of OTC markets

WHAT MAKES US DIFFERENT ?

We propose a paradigm shift for markets, as Yahoo/Google shift for information access.

INTELLIGENT MARKETPLACES

The market is not left to his own devices but overseen by a powerful algorithm that acts as a cooperative meta-agent.

It manages every piece of information in a coherent system, with a full understanding of logical links and observed behaviors.

This provides full privacy and flexibility to make participants express their exact need and to interact with them to reach market optimum, without information leakage.

LIQUIDITY BOOST

For most markets, up to 50% orders consist in strategies, i.e. some logical combination of instruments.

Because they provide price relationships BETWEEN instruments, these strategies contain very valuable information that is lost in traditional platforms, which only support outright orders.

We handle any strategy to collect any available information. This raises the probability of matching and improves the price of instruments and strategies in real time.

RECOMMENDATION MECHANISM

In traditional platforms, it’s over when orders do not match.

For the first time in finance, our marketplaces give recommendations to participants, considering order combination patterns and observed behaviors.

Our algorithm considers orders that COULD match and tells people what to do, generating additional trades.

Our solution is

Agnostic

Our algorithm is agnostic: it allows us to address any instrument and any strategy order. It encompasses most of OTC markets.

Generic

Our platform is generic: we only need to parameterize a financial product and trading session rules to create a new marketplace.

Invisible

Our technology is invisible and scalable: no software installation and no infrastructure. Our environment is completely dematerialized.

FACTS & FIGURES

Exchanges & brokers are moving frontiers

Nasdaq to buy Espeed Platform form BGC for $750Million

April 1 (Bloomberg) — Nasdaq OMX Group Inc. will buy eSpeed, the electronic trading system for U.S. Treasuries, from BGC Partners Inc. for about $750 million in cash…

BGC Partners acquires GFI Group, valued $780Million, for its Trayport and Fenics platforms.

Read more

BGC Partners acquires GFI Group, valued $780Million, for its Trayport and Fenics platform

Stockholders Representing 56.3% Percent of GFI Shares Supported BGC’s Offer; Payment for Shares Tendered Expected on March 3

Independent GFI Board Members Resign …

Read more

CONTACT US

If you have any questions feel free to contact us:

Jennifer Habbouba Attal :

Jennifer.habbouba-attal@smartpills.fr or + 33 1 53 29 31 25

SMARTPILLS

22 RUE DES CAPUCINES

75002 Paris France